- Bitcoin approaching all-time highs, potentially setting up for a parabolic blowoff move

- Institutional crypto flows remain strong, with the second-biggest week ever at $1.8 billion inflows

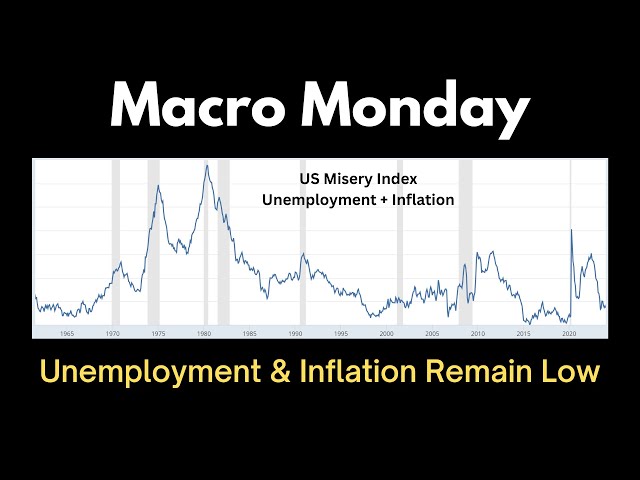

- Unemployment and inflation remain low, but the Fed may continue raising rates if data shows inflation persisting

- Liquidity measures like M2 money supply and reverse repo are declining, which could impact risk assets like crypto

- Housing affordability continues to worsen due to rising prices and mortgage rates

- Legacy tech stocks like the FAANG names are approaching overbought levels, which could lead to rotation into crypto

- Miners have underperformed Bitcoin recently, setting up a potential bounce or further decline relative to BTC

The cryptocurrency market, particularly Bitcoin, appears poised for further gains driven by strong institutional inflows and rotation from overvalued legacy tech stocks. However, potential risks include a parabolic blowoff top scenario, persistent inflation leading to higher interest rates, declining liquidity measures, and underperformance of crypto miners. Overall, the macroeconomic environment remains favorable for crypto, but caution is advised regarding shaky market conditions and the need to monitor data for potential turning points.